By Mark Boundy

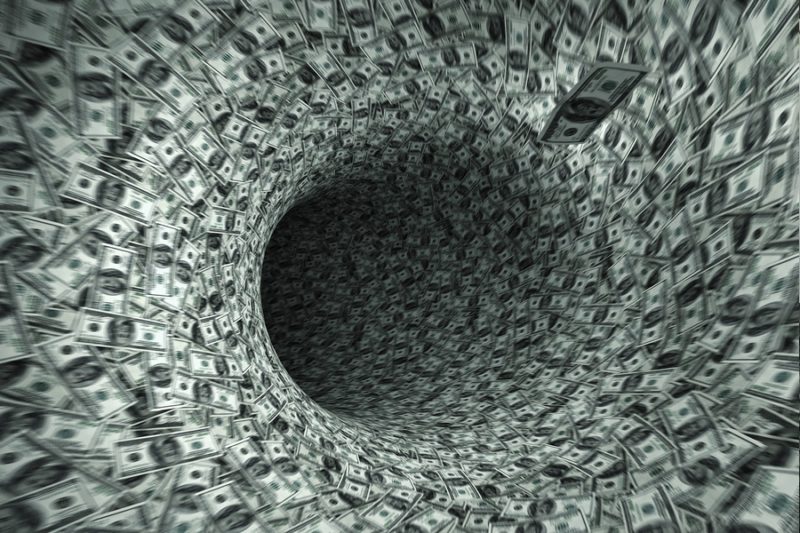

Your 2019 Resolution: Control the Suck of Discounting Expense

Your 2019 Resolution: Control the Suck of Discounting Expense https://csuiteold.c-suitenetwork.com/advisors/wp-content/themes/csadvisore/images/empty/thumbnail.jpg 150 150 Mark Boundy https://secure.gravatar.com/avatar/fda1708afcd4681826f4fb12f56401d9?s=96&d=mm&r=g

There is almost nothing you can do for your business with a higher financial payback than getting your arms around your discounting practices. I want you to make a New Year’s resolution to put rigor and discipline around your discounting (some call it “pricing exceptions”) policy and processes.

Why is this so important for your business? Simple math. When you sell your product or service to a customer, your costs to fulfill your part of the deal are the same—regardless of whether you discounted or not.

Discounting changes only two lines on your P&L statement: the top line and the bottom line.

When you grant a discount, every dollar you surrendered comes off of your bottom line, and goes to the customer’s.

For an operating business, your profits are made at the top line. A pricing and/or discounting decision is what drives profits. Once you see a number on the bottom line, it’s too late to do anything about it. Discount expense sucks the life out of companies.

Resolution Part #1. Take Stock of Your Current Discounting Practices.

I am thrilled to help my readers analyze where their discount dollars go and their system for allocating those dollars. Let’s examine how you make discounting decisions together. If you’d like to prepare, or go through the exercise on your own. Some of the questions we’ll go through:

How many discount dollars do you spend per year?

- Formal, through an exception process?

- Invisible, through salesperson autonomy?

- Does everyone in your company know that discount dollars=profit dollars? Do they act like it?

What is your price exception/discount process now?

- What are the steps?

- Who are the players?

- What information/documentation is used?

- How is the discount justified?

- Is customer value measured/characterized? How?

- Do you always know what the customer thinks of yours andthe competitor’s value (or just their price)?

- How consistently do your people follow your process?

- Have you (or can we) analyze how discount dollars are distributed? Are there concentrations by territory/salesperson, region, customer, industry, time of year? Can we explain any apparent anomalies?

- What do we get in exchange for price concessions?Are there any salesperson/regional/market trends in that data?

What These Questions Uncover.

The first thing we’ll discover is how well you track discount dollars. Since every one of these dollars is also a profit dollar, you need to know where every one goes. If you don’t know where your discount dollars go, your business is leaking profits.

The questions above help both of us understand how you make pricing and discounting decisions, where the discount dollars go, and if there are any suspicious trends.

Are my discount dollars being over-allocated toward:

- The whiniest salespeople?

- The favorite salespeople?

- The whiniest customers?

- A certain market?

- At a certain time of the month/quarter/year?

That last one frustrates the heck out of me: I’ve held P&L responsibility, and have never felt that an unprofitable booking this month beats a profitable booking next month. I’d feel that way even without the perversion of what month-end discounting teaches my customers.

I also want to explore the basis of discounting (whether/how much) decisions. Squeaky wheel? Best at gaming the system? Price-based? Or…value based?

The Gold Standard of Discount Systems: Customer Value Based.

99% of the time you hear “your price is too high”, what the person is really saying is either “your value is too low”, or “I’m inviting you to help me understand your value”. I specialize in helping my clients have those discussions effectively. I can point you to a methodology which will steer those conversations toward value and away from price…and certainly away from unnecessary discounts.

If you have a solid methodology for understanding customer value, some great things happen to your discounting practices:

- Discounting is purposeful. It no longer feels as random or arbitrary.

- Your people will understand the system and feel more fairly treated

- You might quiet the squeaky wheels; the people who scream the loudest for discounts.

- You will be confident in your discounting decisions.

- You’ll make better decisions about product enhancements, market entries, even market exits.

- You will discount less and profit more.

- You will produce more accurate forecasts. Knowing customer value is the same as knowing customer motivation. When you truly know value, you are intimately engaged with the customer’s innermost buying decision dynamics.

Resolution Part #2. Build A Value Based Pricing/Discounting System.

I can help you if you want. Here are some options:

1. I’m feeling pretty good about the latest draft of my book on the subject. If you’ll give me merciless feedback on it, I’ll send you a .pdf copy to review. The book will guide you toward developing a better pricing/discounting system.

2. Let’s talk. Reach out at mark@boundyconsulting.com. If you want to work toward a system together, prepare for our call by looking through the “take stock” questions above, and prepare any questions for me.

Whatever you do, and however you choose to get help, please do it. The road to failure is paved with poorly justified discounting decisions. I want you on a better path.

To your success!