Why alternative assets are becoming the new normal

Why alternative assets are becoming the new normal https://csuiteold.c-suitenetwork.com/wp-content/uploads/2017/07/why-alternative-assets-are-becoming-the-new-normal.jpg 657 404 C-Suite Network https://csuiteold.c-suitenetwork.com/wp-content/uploads/2017/07/why-alternative-assets-are-becoming-the-new-normal.jpg|

- August 2017 issue

Emma Wheaton has worked as a magazine journalist and editor for a variety of print and digital publications covering business, lifestyle, design and travel for the past 10 years. Born and raised in Sydney, she is now living in Stockholm where she is the Features Editor – Europe for The CEO Magazine.

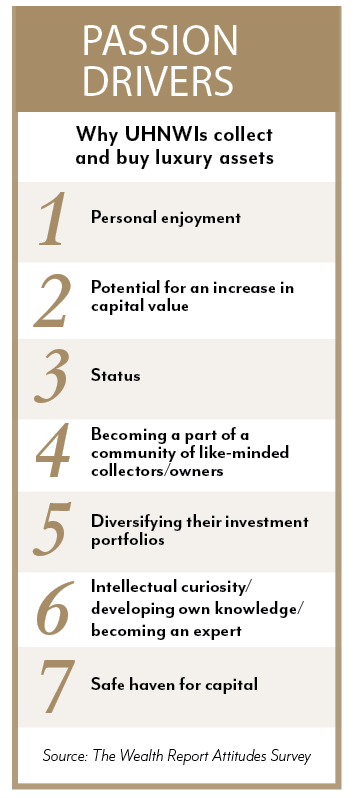

Reducing risk by spreading your investment dollars around is nothing new; we all know not to put all our eggs in one basket. Increasing market volatility and general global uncertainty are just a couple of the reasons why more and more people are looking at different ways to diversify their investment portfolios.

McKinsey first pointed out the trend for alternative portfolio allocation back in 2012, when the pace for its growth more than doubled in a six year period and outstripped traditional asset classes. Today, PwC predicts further growth to the point that the phrase ‘alternative’ will no longer be relevant. By 2020, it says, alternatives and passive products will represent 35% of the asset management industry.

Tom Gearing, Managing Director of wine investment company Cult Wines, points out that the mere fact that traditional institutions, such as UK bank Coutts, are even reporting on alternative investments is a signal of the shift in itself, referring to the bank’s annual Objects of Desire Index.

Tangible assets, collectibles, passion investments, objects of desire – whatever you want to call them, there is money to be made.

Four Wheels

The value of classic cars has grown by 9% in the past year and by 457% in the decade to 2016, according to the 2016 Knight Frank Luxury Investment Index (KFLII). Over that 10-year period Porsche and Ferrari have been the best performing car brands. A Ferrari 1957 335 Sport was the most expensive car to ever be auctioned, selling for a jaw-dropping €32 million.

Meanwhile, the exact price for the most expensive car to ever be sold has never been revealed. Having said that, a 1962 Ferrari 250 GTO is believed to have been the object of the biggest deal ever struck – reportedly selling for more than the US$38 million paid previously for another 250 GTO.

“The international collector car market is now a multibillion-dollar business,” says James Nicholls, Classic Car Specialist of Mossgreen auction house. “Rare and desirable cars with good provenance and history, in good original condition are now very valuable assets.”

However, what’s the use of owning…